Six accounts, travel benefits, an award-winning banking app and +0.50% interest. Plus is for you if you want to make your life easier when you're on the move.

Accounts

Plus.

Apply for your account directly from your mobile phone.

+0.50% interest on all the money in your accounts. The interest rate is variable.

Danish and English-speaking support until 17:00 on weekdays

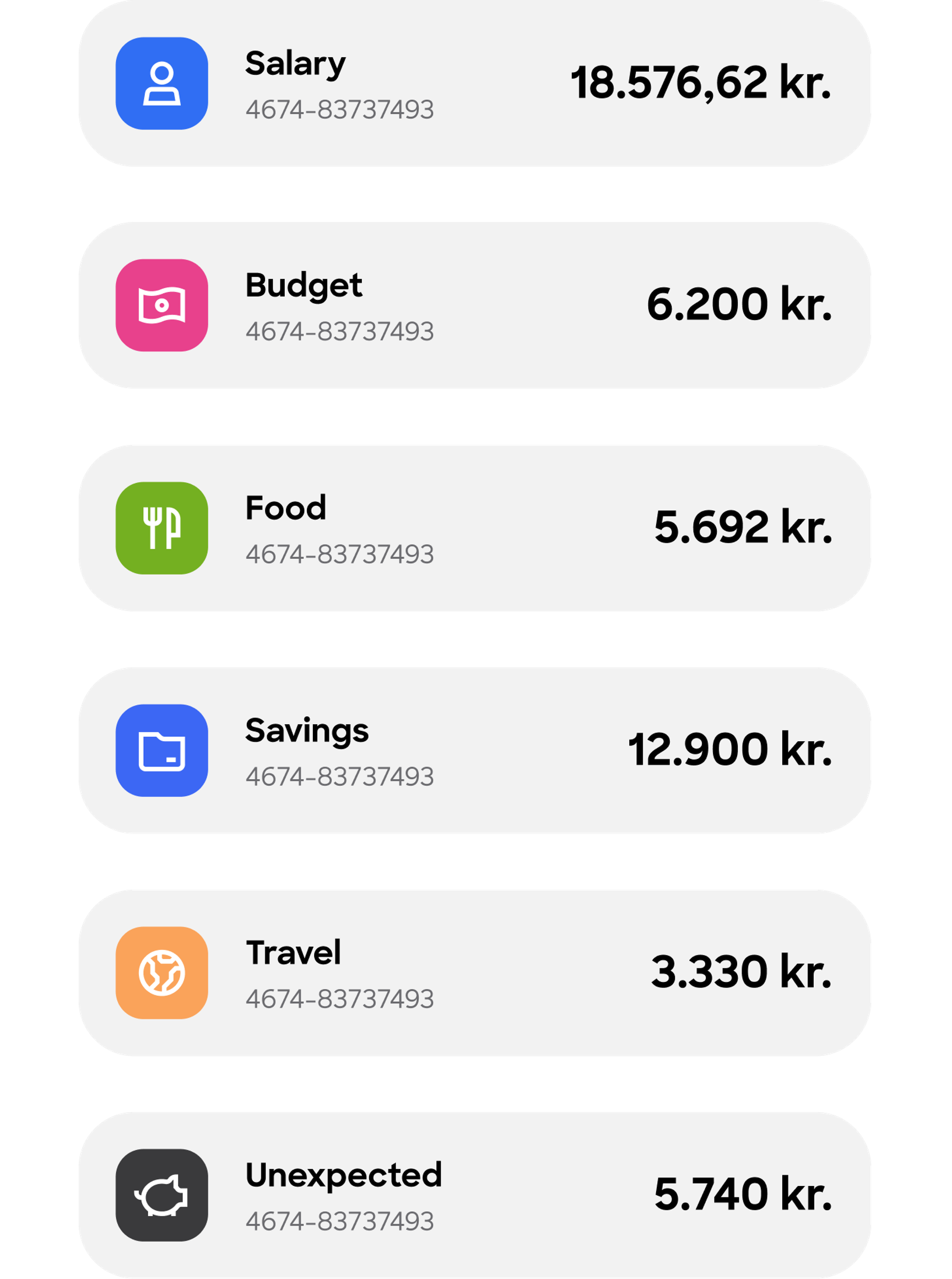

6 accounts. For a detailed overview of your spending.

The more accounts – the more detailed your financial overview. With Plus, you'll get six accounts that you can use for whatever you like.

That could mean separate accounts for your salary, travel, budgeting, food, gifts, or unforeseen expenses.

The only limit is your imagination.

Award-winning banking app - managing your money the smart way.

Whether at home or abroad, our award-winning banking app will help you manage your money the smart way so you can make taking care of finances easy.

With Plus, you’ll also get full access to all the Lunar app features. So you can create different budgets, get notified on any account movement, save automatically when you use your Visa card – and much more.

Travel benefits wherever you go.

New York, Naples, or New Delhi? Whatever your destination, you're covered.

With Plus, you’ll get worldwide travel insurance from Tryg, and we won’t charge any withdrawal or exchange fees when you use your Visa card.

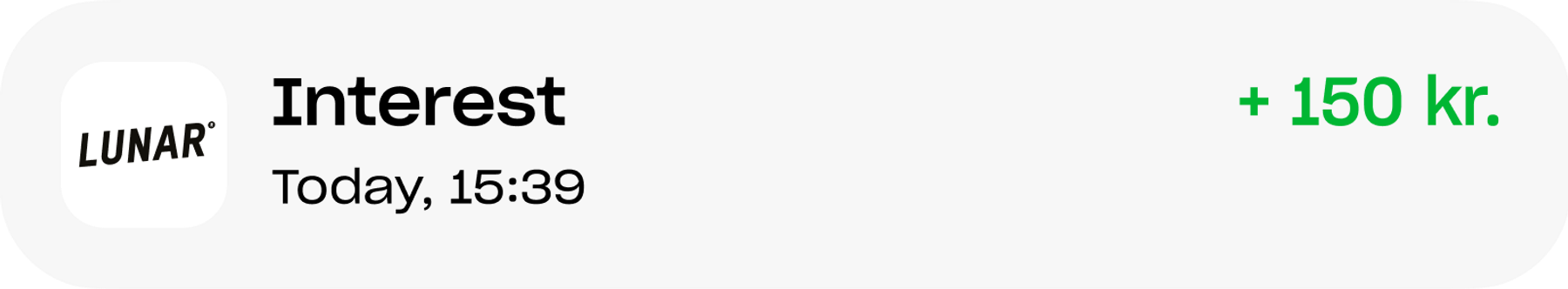

+0.50% interest on all the money in your accounts.

You’ll get +0.50% interest on your Plus accounts. The interest rate is variable.

Your money is also covered by the Guarantee Fund up to 100,000 EUR (approx. 750,000 DKK).

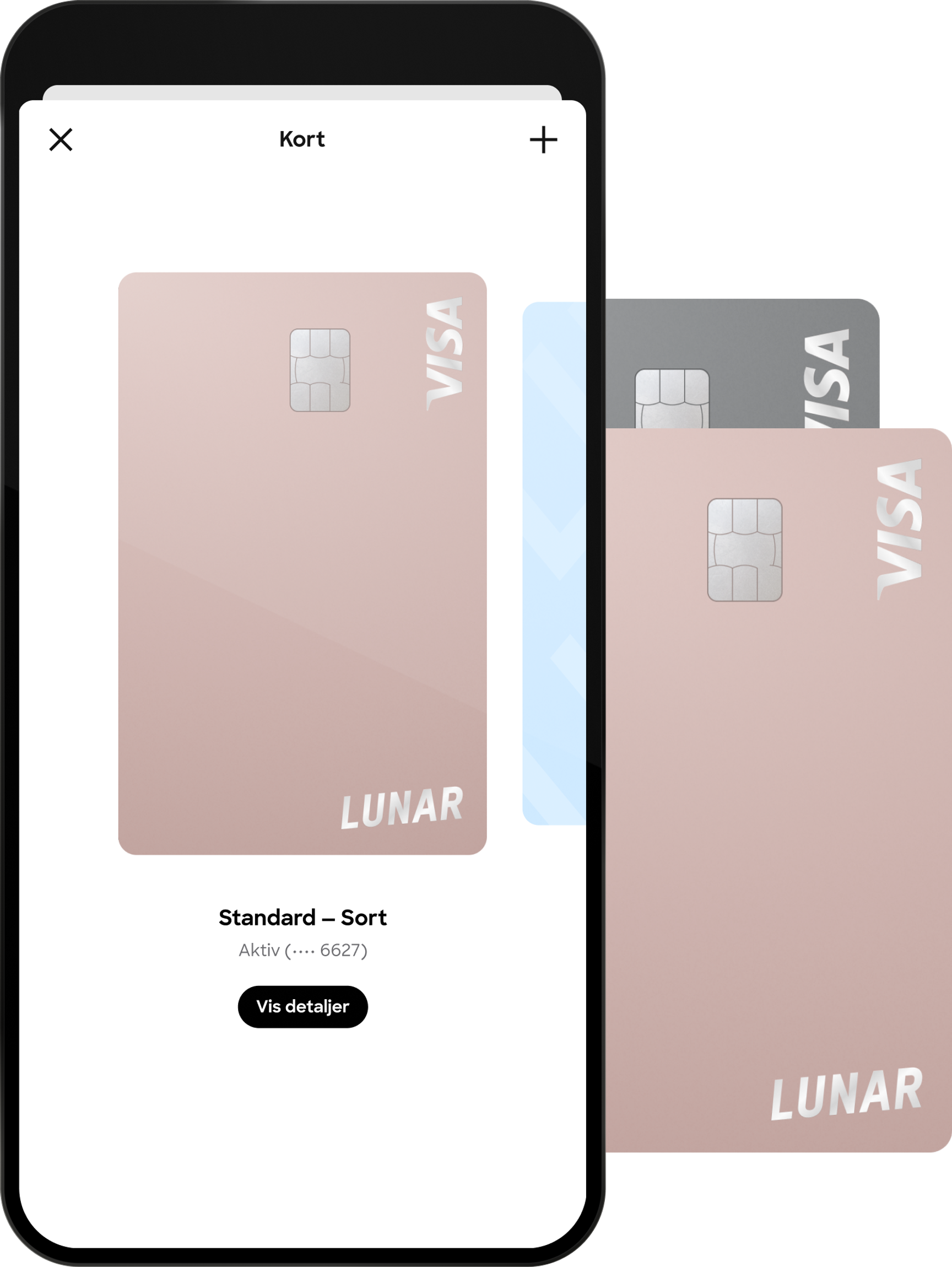

3 physical cards and 6 digital cards.

More accounts – and more cards.

With Plus, you get three physical cards and six digital cards, and you can add all of them to Apple Pay or Google Pay. So you can pay with your mobile phone at home and when you’re travelling.

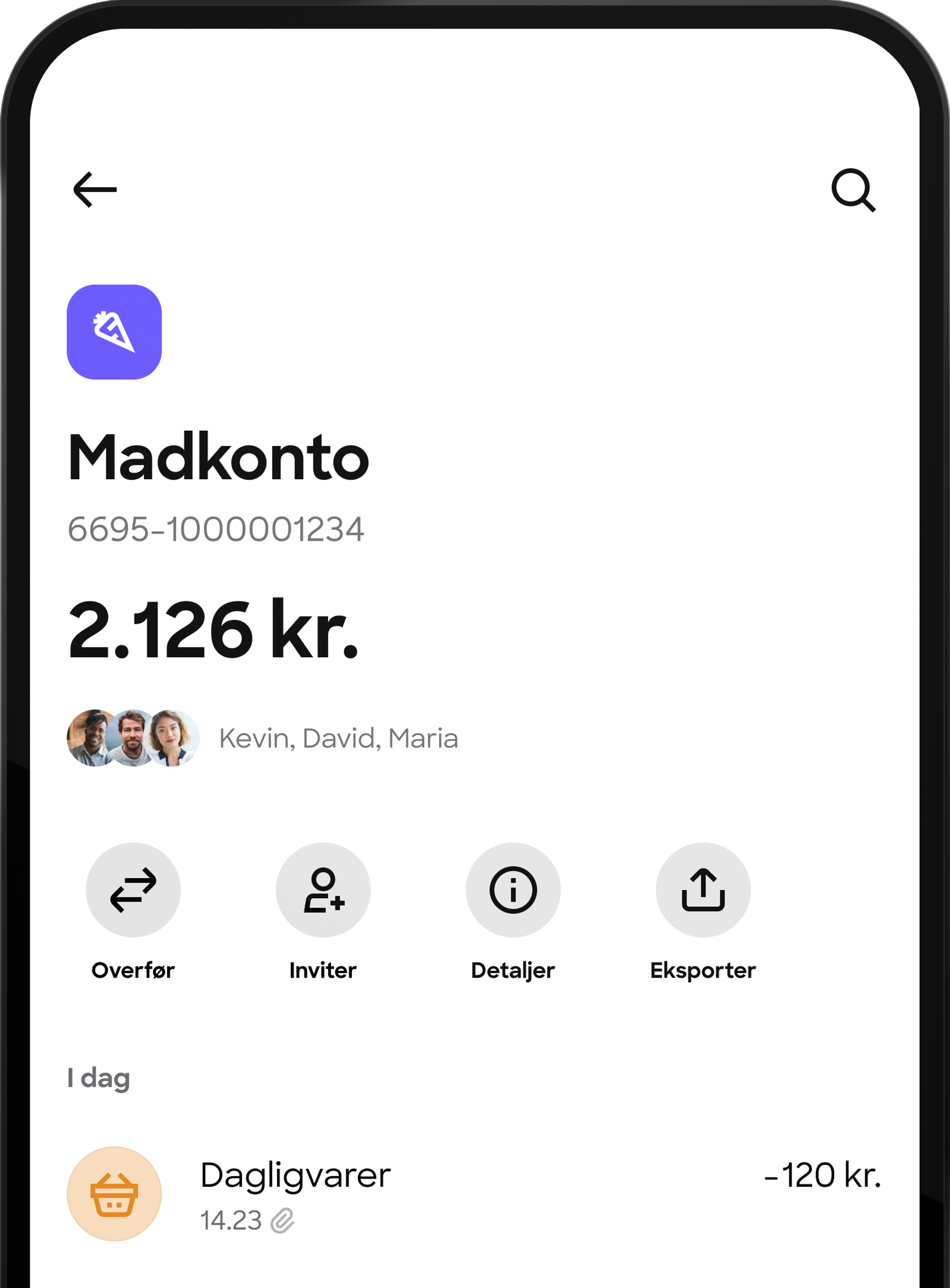

Joint account – share your economy with up to 10 others.

With Plus, you can create and share a joint account with up to 10 people. Share it with your partner, family, or friends.

The account is for you if you want to avoid the hassle of splitting bills and getting into arguments about who should pay for what.

Need some help? Reach us until 17:00

Get Danish or English-speaking support and reach us until 17:00 on weekdays.

Just call or write to us via the app.

Compare Plus to other plans.

Compare Plus to other plans.

Choose between our four different plans. No hidden fees - just fair, transparent prices.

Light

0 DKK /month

A free account catering to all your basic needs.

- No-cost account with a free digital card and basic tools for easy money management.

Standard

39 DKK /month

Tools tailored for your day-to-day finances. Manage your money smarter.

Everything Light has to offer – and more:

- 3 accounts with physical and digital cards.

- Automatic savings, Joint account, budgeting by category, and so much more.

- +0.25% interest on up to 100,000 DKK.*

- Most popular

Plus

79 DKK /month

Multiple accounts and travel benefits that make life a little easier at home and abroad.

Everything Standard has to offer – and more:

- 6 free accounts with physical and digital cards, including access to Lunar Youth.

- Worldwide travel insurance from Tryg.

- No withdrawal or exchange fees.***

- +0.50% interest on your entire balance. Interest is variable, calculated annually and paid out monthly.**

Unlimited

149 DKK /month

Get a personalized metal card, our highest interest rate, and a SAS EuroBonus Lunar card.

Everything Plus has to offer – and more:

- An unlimited number of accounts with physical and digital cards.

- SAS EuroBonus Lunar card included.

- A stand-out metal card with personalised laser engraving.

- Extended travel insurance with Tryg.

- +1% interest on your whole balance. Interest is variable, calculated annually and paid out monthly.**

- Wolt+ included.

How to apply for your account

- 1

Download Lunar for free from App Store or Google Play.

- 2

Apply directly from the app in minutes.

- 3

Within a few days, we'll give you an answer to your application.

Your questions answered

What do I get with Plus?

Plus is for you if you want to make your life easier when you're on the move.

With Plus, you’ll get:

- 6 accounts, 3 physical cards and 6 digital cards.

- Full access to our award-winning banking app to help you manage your money the smart way (winner of E-handelsprisen "Best e-commerce App" in 2022).

- +0.50% interest on all the money in your accounts. The interest rate is variable.

- Travel benefits all over the world.

... and much more.

You can choose Plus in the app when you apply for your account.

Compare Plus with our other subscriptions here

How quickly can I get started with Plus?

How much does Plus cost?

What is Lunar?

Do I need to switch banks to get Lunar?

How safe is it to use Lunar?