Guide: 7 simple steps to improve your finances

Are your finances as you would like them to be? Do you have any money left at the end of the month? Do you ever reach your savings goals? If you can say “No” to just one of these questions, then this guide is for you.

Are your finances as you would like them to be? Are you tired of living from paycheck to paycheck? Have you given up on reaching your savings goals?

Luckily you can change that. Because here we give you 7 simple steps to improve your finances at the threshold of a new decade.

After completing the first 5 steps, you’re already well on your way to improving your finances. The 6th step helps you reach your goal.

The 7th and final step helps you to continue evolving and developing your financial dreams, so they always match your life no matter how it unfolds.

1: Figure out what your financial goal is

The first thing you should do is figure out what your financial goal is and why you want to achieve that goal.

It might be that you have a lot of debt, and you want to have financial freedom? Perhaps you dream of traveling the world to be plentiful on experiences? Do you want to retire early to get the most out of life? Do you have the ambition to be your own boss and want to save up to start your own business?

Ask yourself; What do I dream of, and why?

Your goals, your timeframe and your financial opportunities can change a lot over time. Still, no matter where you are in life when starting this journey, you need to have a clear and defined end goal. Without it, you won’t know which direction to take, what tips to apply to your process, and what to do if you steer off course.

Get Lunar here.

2: Plan the entire route - roughly

It might be that reaching your goal is pretty straightforward and easily achieved. It might also be that the road from A to B really is the road from A to D. That means, you have to take a detour to B and C before reaching the final destination - D.

That’s why it’s essential to have a plan. The grand scheme doesn’t have to be written in detail. But you need to have a rough idea of the road ahead, and what you have to do, to get where you want to go. Then break down the large plan into smaller ones.

For example; Your goal can be to start investing, to retire early. But you’re also in debt and you also want to put aside money for a buffer for unexpected expenses.

Figure out what obstacle to tackle first. A good rule of thumb is to pay of debt as quickly as possible. Another great rule is also only to invest money you can live without. Knowing this, a good plan going forward could be to;

- Pay of debt - make a plan for this first.

- Put money aside for a buffer - make a plan for this when your debt is paid off.

- Start investing - make a plan for this as you start setting money aside to invest.

Want to start investing? With Invest it’s easier than ever to invest in the brands you love - even for you who’s never invested before. Read more here .

3: Make a budget

To get the details in place and to create a realistic timeframe of your financial project, you need to make a budget.

First; Write down ALL your sources of income.

Second; Write down ALL you expenses - rent, phone bill, food, insurances aso.

Also; Look at your general spending pattern. Do you spend a lot of money on cabs, dining out, shopping or candy on the weekend? Is there something in your spending pattern you can change to help reach your big financial goal faster? Then do it.

Do you want to get an overview of your spendings that quickly helps you pinpoint your habits? And what about an interactive budget that helps you stay on track of your financial goals? Try Lunars spending and budget feature. Get Lunar here.

4: Find ways to motivate yourself

Many who wants to improve their finances will experience a period of struggles, no fun at all and wanting to give up.

Especially, if paying of debt is part of your strategy, there will be luxuries you have to let go of (at least for a while) until you reach your goal.

Motivation is a beautiful thing to have, but in most cases, it will be sheer will power that carries you across the finish line. Here your overall goal and the purpose for reaching it - as we discussed in step 1 - can help you through the rough patches.

It’s also a good idea to visualize your goal and/or the journey towards it in a way that makes sense to you. Markdown every payment in a book, on a board or on a piece of paper on the fridge. Anywhere that keeps your progress in plain sight.

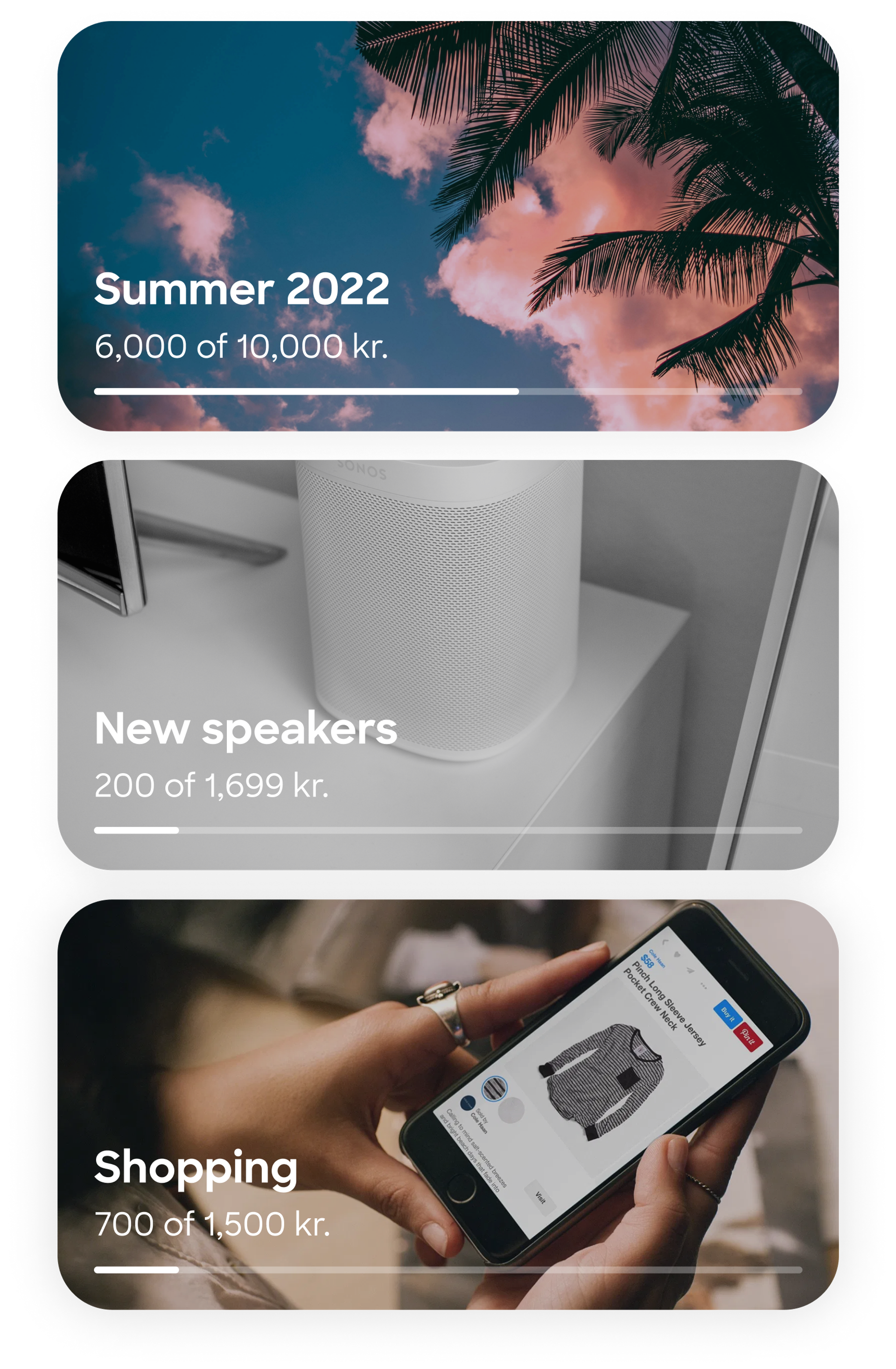

You can also use more creative ways to mark your progress. At Lunar, you can use the savings feature Goals. With it, you can divide every saving into a goal, and give each goal a name and picture that visualizes your personal dream. You can also add an array of automatic payments to help you automate the process.

Which brings us to the next tip...

5: ACTIVATE THE AUTOPILOT

The easiest way to make sure that you do the things necessary to reach your financial goal is to put as much of it as possible on autopilot.

Create automatic transfers. That way bills, debt and savings are always paid first.

The Lunar feature Goals helps you make automatic transfers on a daily, weekly, monthly, quarterly and yearly basis. You can also set it to Round-up and transfer a small amount of your choice to your savings account whenever you swipe your Lunar Black Card. Easy.

Want to give Lunar a try? It’s free, non-committal and we don’t care if we’re your only one, or if you have several other banks on the side. You decide. Get the Lunar app here.

6: Evaluate and adjust

When you’ve completed the first 5 steps, it’s time to evaluate and adjust if need be.

Like we said in step 1, finance is a creature that changes over time. Not just because of your age, but also because of new priorities, change in spending habits also.

That’s why it’s a good idea to set some time aside (at least an hour a month) to go over your progress, your budget and your overall plans.

There is also a chance that you will slip and fall back into old habits at least once. A monthly check-up is a way to ensure that you stop yourself in your tracks before old patterns turn into another failed attempt to change your financial situation.

If you think a monthly check-up is a lot then put it into perspective;

You spend an incredible amount of hours making money - for most people, it’s 37 hours a week/148 hours a month. In that respect, a few hours each month is not a lot of time to spend on making sure that you get the most out of your hard-earned money.

7: Enjoy your progress and take it to the next level

Getting a handle on your money can be a stressful affair - especially if you have a lot of cleaning up to do.

So remember to stop, reflect, and enjoy the fact that you have taken significant steps to change your financial situation both now and in the future.

It's okay to go to the movies once in a while, go out to dinner or do other things that you enjoy. As long as it isn't overdone and derails your plan, it'll be fine.

As you get closer to your final goal, you might experience bigger joy and energy because of your renewed financial situation.

Use that energy by taking the next step. Make your budget bigger, so that you are not only prepared for each month but perhaps for the whole year. That way you can help yourself to always have money for holidays, birthday presents, vacations also.

Maybe you have new dreams that you want to aim for that will be quicker to realize because your financial situation is better than when you first started.

It's your finances and your money. You decide.

And remember, it's never dumb to ask for help if you don't know what to do or is stuck.

So get started today.

Create your plan and make 2022 the year you improve your finances.

Want to give Lunar a try? It’s free, non-committal and we don’t care if we’re your only one, or if you have several other banks on the side. You decide. Get the Lunar app here

You might also like...

Expat or student? How to get a free Danish bank account easier than ever.

Get a free Danish bank account and digital card as a non-citizen all safe and digital. Manage your money and NemKonto in an English banking...

Control your finances like a Pro with multiple accounts.

It pays off to get three bank accounts to manage your personal finances. Get inside tips from a real pro - Lunar’s head of credit - and the...

New to investing? Here are 15 expressions you need to know

Investing is actually not that hard to get into as you may think. The first step is learning the lingo. So here are 15 expressions you need...

How you are covered by your Lunar Plus and Unlimited travel insurance

You bring your card everywhere. That’s why we have included one of the best travel insurances in Plus and Unlimited. You are covered all...