Lunar raises €46 million to accelerate Nordic growth

Nordic challenger bank Lunar today announced a €46 million capital increase to scale its fast-growing business banking, develop its lending proposition, and support continued expansion across the Nordics.

The €46 million investment is led by a mix of existing and new shareholders and will accelerate momentum in business banking alongside the build-out of lending and expansion into Norway and Finland. Together, these priorities enable Lunar to pursue growth and profitability in parallel as it continues to scale its role as a Nordic full-service bank.

“We can see that our strategy is working. More users are choosing paid subscriptions, and we are seeing strong momentum in our business customer base reaching 40,000 business users in January. The new capital allows us to continue scaling what already works for consumer and business banking while increasing our footprint across the Nordics. We’ve already come a long way, but we are focused on unlocking a significantly larger opportunity for Lunar while reaching profitability in 2026,” said Ken Villum Klausen, founder and CEO of Lunar.

Strong investor interest

The capital raise attracted strong interest from Lunar’s existing shareholder base, reflecting continued confidence in the company’s strategy and execution. The round also introduces 100A, a London-based fintech investor focused on Series A and beyond, alongside existing shareholders Heartland and Orbit Alliance.

“That our existing investors continue to back Lunar means a great deal to us. At the same time, the interest from a new investor shows renewed confidence from the market in where we are heading,” Klausen added.

1 million and beyond

Today, Lunar serves more than one million users across the Nordics, with a steadily increasing share choosing paid products. In its most recent half-year results, Lunar reported strong growth across both consumer and business customers.

With its own banking licence and proprietary infrastructure, Lunar also underpins Moonrise , its payments and banking services platform. This foundation positions Lunar to capture broader opportunities beyond consumer and SME banking, while enabling faster execution, continuous simplification, and products built around real user behaviour rather than legacy systems.

“Banking is moving toward becoming something that operates quietly in the background. By removing friction and building systems that scale seamlessly for consumers, businesses, and partners, banking becomes more invisible and more agentic - adapting to how money is used rather than forcing users to fit the system,” said Ken Villum Klausen.

You might also like...

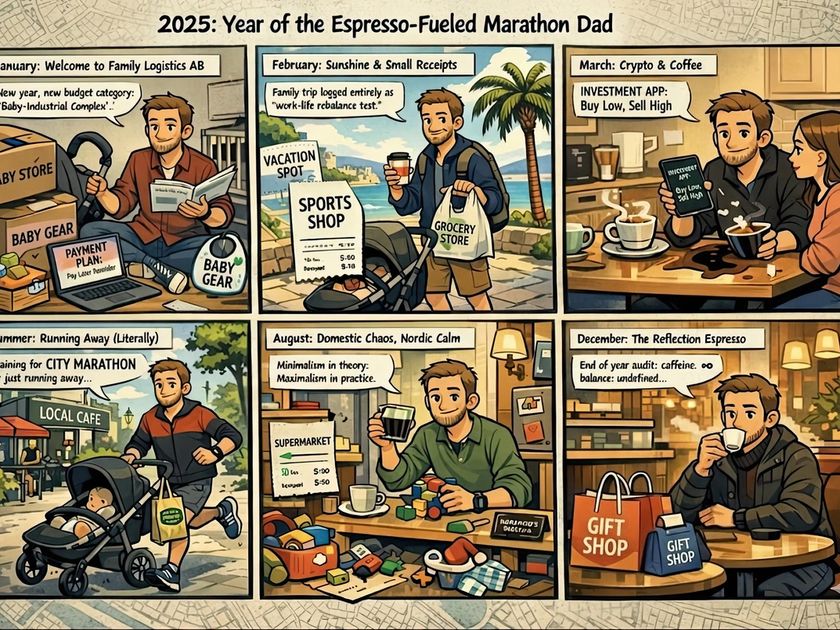

Lunar launches “Wallet Story” – your banking year as a comic

For the first time, bank customers in the Nordics can see their banking year as a personal story rather than rows of numbers and tables....

Lunar appoints Chief Product Officer

Lunar appoints Mette Hindborg Gade as its new Chief Product Officer (CPO), strengthening the company’s product leadership as Lunar enters...

Lunar first in Scandinavia to receive MiCA license for crypto services

Lunar has been authorised as a Crypto-Asset Service Provider (CASP) under the EU’s new Markets in Crypto-Assets (MiCA) regulation, making...

Lunar takes to the clouds - first Nordic bank to begin processing Visa cards with cloud native Pismo platform

Visa, a world leader in digital payments, and Pismo today jointly announced that the Nordic challenger bank Lunar will start Visa card...