Begin investing without choosing just one single stock. With ETFs, you can invest in a broad array of stocks, which have been gathered for you beforehand, and in that way, spread out your risk.

Invest

Invest smart without being an expert.

Get started in minutes

Easy, manageable and cheap

Avoid choosing stocks yourself

Investing made easy.

Investing doesn't have to be hard. And not at all if you invest in the app's ETFs.

An ETF (exchange-traded fund) is a group of businesses which are put together in an index fund, and are traded on the stock exchange just like regular stocks.

With ETFs, you're investing in several businesses in the same index. It could be American stocks, green businesses, or tech. The object is to follow the development of companies in the same category to get a yield that reflects many companies and not just single stocks.

Said differently, you get a small bite of all the stocks instead of having to choose one. It's easy and manageable - even if you've never invested before.

Why investing in ETFs is smart.

ETFs is for you, who is completely green to investing, but also for you who is a real pro. You don't need to be an expert, have lots of money, or a lot of time.

It's becoming more and more popular to invest in ETFs, and there are several reasons as to why:

- It's easy to buy and sell ETFs because you can invest whenever the market is open.

- You will spread out your risk quickly, which would take a long time to achieve if you purchased single stocks.

- The costs are lower than e.g. traditional mutual funds.

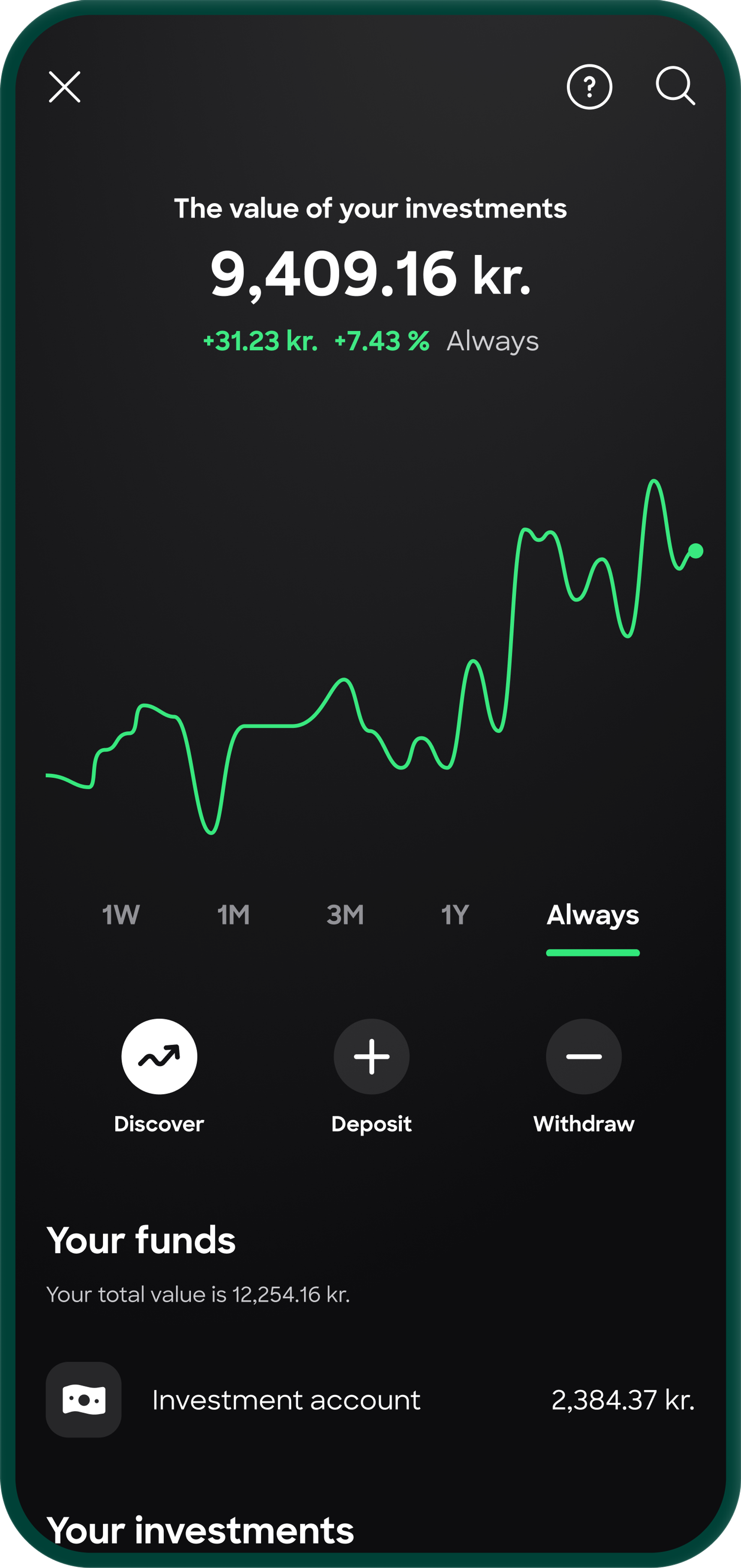

Make your money grow.

Make your money grow.

Get an overview in the app.

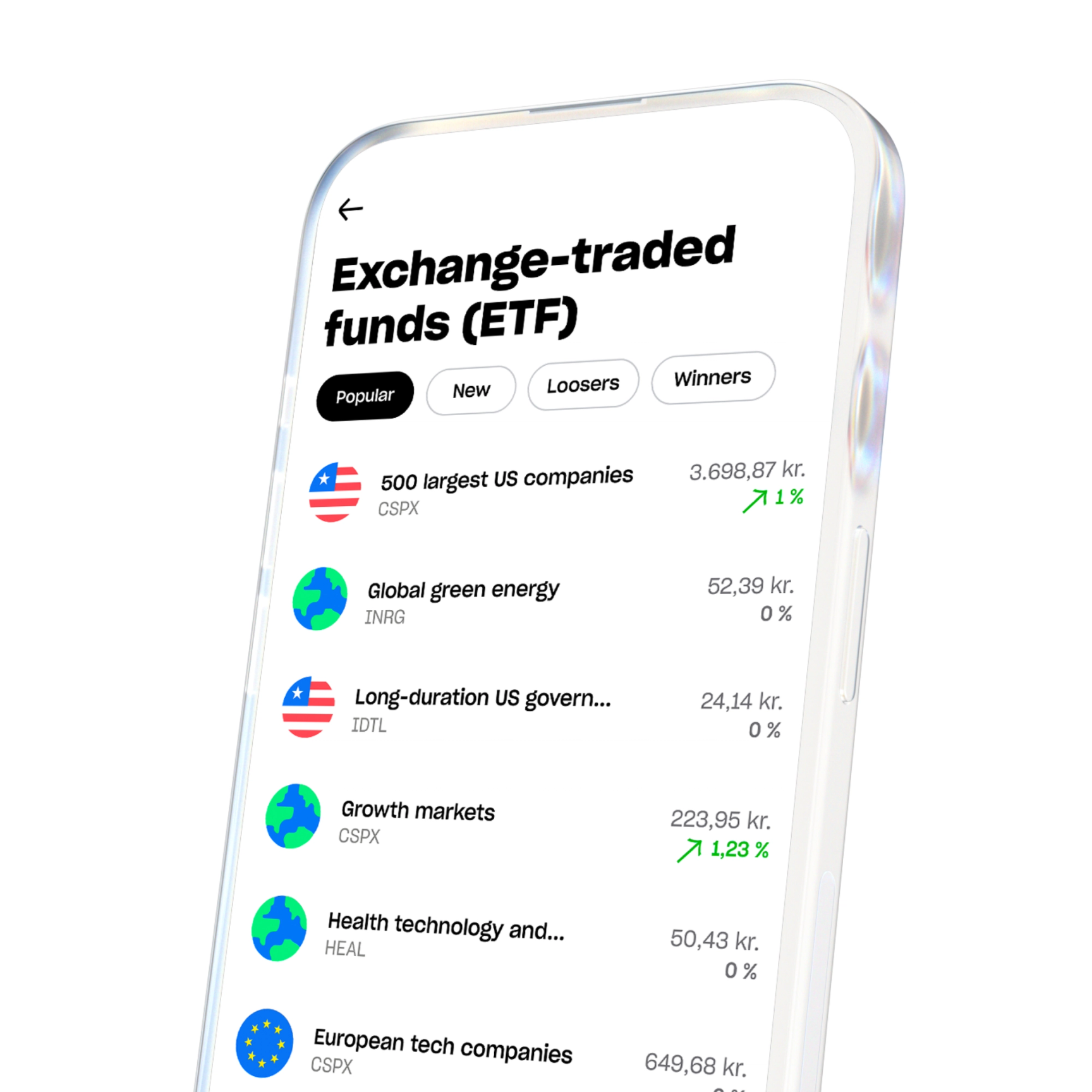

iShares, S&P500 og MSCI Emerging Markets. Huh? Traditionally, most of ETF's have names, that can make most people dizzy. But we've made it easy for you, and let go of all the 'suit-lingo'.

Instead, we've called our ETF's things that are easy to understand. We've also given them all a short explanation, so it's 100% clear which businesses they cover. You'll get the complete overview in the app, so you can get started in minutes.

Invest in what interests you.

There are a lot of ETFs and they can be difficult to filter through. We have chosen some of the most popular ones and have categorized them in the app, so it's manageable for you to get started. We continuously add new ones.

Do you have the most faith in renewable energy, tech, or IT? Or do you have a specific special interest?

Invest in what makes sense to you.

Low prices and no hidden fees.

When you invest in ETFs, the costs are lower than with traditional mutual funds. In the Lunar app, you can easily get an overview of the price of each ETF. You get full transparency, and we have no minimum amount on how much you can trade with.

It costs 19 DKK to buy and sell when you invest for under 50,000 DKK Since an ETF is a fund you pay an annual percentage rate (APR), as an administration fee. It's percentages of the amounts you've invested with. The cheapest one costs 0.03% annually. This means that if you invested 10,000 DKK in the cheapest fund, you pay 30 DKK in ARP.

It's this easy to get started with Invest

- 1

Sign up to Lunar for free

Download Lunar for free and sign up for Invest in the app. You can use us with your current bank without problems.

- 2

Find your ETFs

Get the overview of ETFs easily in the app, and choose the one(s) that fit you best.

- 3

Make your first trade

Invest in your ETF with a single swipe

Investment involves risk.

When you invest with Invest, you do it through Saxo Bank.

There is always a risk when you invest money. The value of your investment can both rise and fall and in some cases, you may lose the entire amount you have invested. We provide factual information about movements in the stock market, but previous developments in the stock market are not always an indication of future developments.

We don't advise on investments, and we don’t make recommendations for either buying or selling shares. Information provided by Lunar is not advice on where or how to invest your money, and all decisions are up to you alone.

YOUR QUESTIONS - ANSWERED

What is Lunar?

Lunar is a digital bank without any physical branches. Yet we offer all the services you associate with a traditional bank; that being accounts, Visa cards, payment transfers, loans, MobilePay, Apple Pay, Google Pay, etc. On top of that, we provide the best banking app experience in Denmark, where it’s safe and easy for you to manage your finances. Directly from your smartphone.

The app provides you with all the features you’ll need to get the most out of your money. We offer you new ways of keeping track of your expenses, interactive budgets, and notifications every time you spend money. You’ll avoid any payments and transaction fees, too. On top of that, you’ll design your own Visa card. Getting a card and an account is free.

We have more than 1,000,000 users in the Nordic region, and we have offices in Aarhus, Copenhagen, Stockholm, and Oslo. Our +450 employees work every day to give our users the best possible bank.

Do I need to switch banks to get Lunar?

What's an ETF?

Why are ETFs so popular?

How are ETFs taxed?