Lunar announces lapse of offer since regulatory approval has not been obtained.

Lunar announces that it has not been possible to obtain regulatory approval of the acquisition of the Norwegian bank, Instabank.

Unfortunately, the change in the economic environment during 2022 has made it difficult to secure binding commitment on the necessary additional capital to meet the Norwegian FSA and the Danish FSA’s capital requirements in order to obtain the required regulatory approval of the acquisition.

Thereby, the offer has lapsed as September 30th was the drop-dead date agreed between the parties.

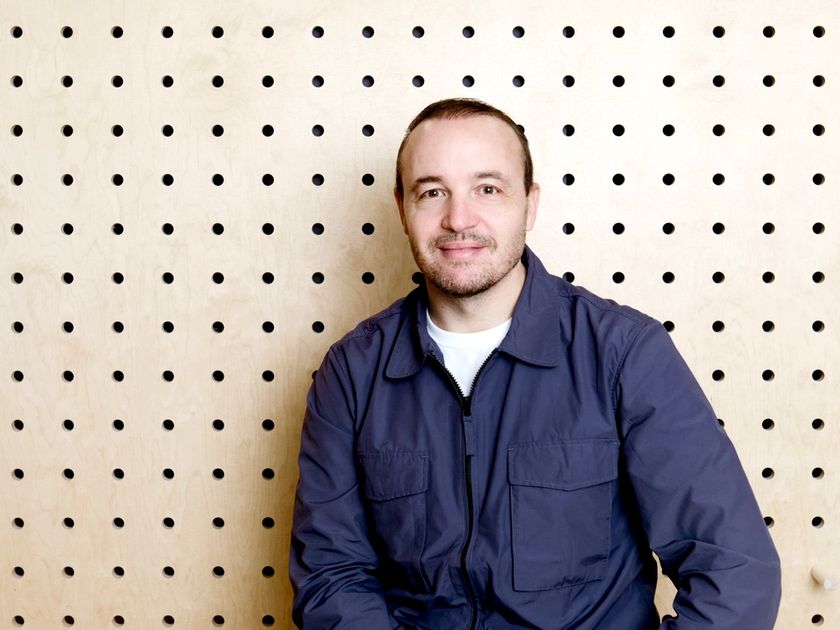

“Unfortunately, the market conditions have changed drastically, and they do not allow Lunar to obtain the regulatory approval needed to complete the acquisition of Instabank. We have done everything reasonable in our power to raise the capital needed to meet the capital requirements and obtain the approval from the Norwegian FSA. It is very unfortunate that we are not allowed to join forces with Instabank, which we see as an exciting company and a great match,” says CEO and founder of Lunar, Ken Villum Klausen.

Lunar recently announced a capital raise of 212m DKK on September 19th, but this has not been sufficient to obtain regulatory approval.

Lunar and Instabank together announced the acquisition of Instabank on March 28th pending the regulatory approval. The acquisition was supported unanimously by the Board of Directors in both Lunar and Instabank.

Since the announcement of the offer in March, Lunar has been in ongoing dialogues with the Danish and Norwegian Financial Supervisory Authorities (FSA) to obtain the required approval to complete the offer.

In May, the Norwegian Financial Supervisory Authority informed that extra capital requirements would be needed to approve the acquisition.

Lunar has worked tirelessly to meet the extra regulatory requirements since, but it has not been possible to raise the sufficient capital to obtain the regulatory approval.

You might also like...

From office lights to living rooms, we now match all our employees’ electricity use with renewable energy

This change is about doing what we can here and now. We’re extending renewable electricity matching from our offices in Sweden and Denmark...

AI Support now resolves 85% of cases on its own, with top ratings to match. Here’s how.

AI chatbots are everywhere, but too often they miss the point. You type a question into a chat bubble, get something almost useful back,...

Travel Costs Are Predictable. Your Card Fees Should Be Too.

Roaming charges in the EU are no longer an issue, making phone use abroad simple and predictable. Paying with your bank card, however,...

Imagine seamless, quick payments across borders. Now a reality.

International payments are now faster, more transparent, and more cost-effective. Through our partnership with Wise Platform, you can send...