Get an interest savings account with a fixed interest rate of up to +1.75%. The interest savings account is for you, if you want more positive interest if you bind your money for 3 months, 6 months, 1 year or 3 years.

Get up to +1.75% interest

Interest savings account with our highest interest rate.

Get up to +1.75% interest. Deposit between 25,000 and 1,000,000 DKK.

Payout each month.

Interest guarantee: Fixed positive interest for up to 3 years.

Fixed positive interest for up to 3 years.

With an interest savings account you can earn more than our standard interest rate – when you bind your money for 3 months, 6 months, 1 year or 3 years.

The interest rate depends on which plan you have, and how long you bind your money.

The interest will be calculated annually and paid out monthly.

Get a higher interest rate - depending on your plan.

| Light | Standard | Plus | Unlimited | |

|---|---|---|---|---|

| Deposit rate 25.000-1.000.000 DKK for 3 months | +1.50% | +1.50% | +1.75% | +1.75% |

| Deposit rate 25.000-1.000.000 DKK for 6 months | +1.25% | +1.25% | +1.50% | +1.50% |

| Deposit rate 25.000-1.000.000 DKK for 1 year | +0.75% | +0.75% | +1.00% | +1.00% |

| Deposit rate 25.000-1.000.000 DKK for 3 years | +0.75% | +0.75% | +1.00% | +1.00% |

Your money is safe with us.

Feel completely secure depositing money into your Lunar savings account. You’re covered by the Danish Guarantee Fund (Garantiformuen), which means that your money is safe with us.

Find the plan that suits you best.

Find the plan that suits you best.

Light

0 DKK /month

A free account catering to all your basic needs.

- No-cost account with a free digital card and basic tools for easy money management.

Standard

39 DKK /month

Tools tailored for your day-to-day finances. Manage your money smarter.

Everything Light has to offer – and more:

- 3 accounts with physical and digital cards.

- Automatic savings, Joint account, budgeting by category, and so much more.

- +0.25% interest on up to 100,000 DKK.*

- Most popular

Plus

79 DKK /month

Multiple accounts and travel benefits that make life a little easier at home and abroad.

Everything Standard has to offer – and more:

- 6 free accounts with physical and digital cards, including access to Lunar Youth.

- Worldwide travel insurance from Tryg.

- No withdrawal or exchange fees.***

- +0.50% interest on your entire balance. Interest is variable, calculated annually and paid out monthly.**

Unlimited

149 DKK /month

Get a personalized metal card, our highest interest rate, and a SAS EuroBonus Lunar card.

Everything Plus has to offer – and more:

- An unlimited number of accounts with physical and digital cards.

- SAS EuroBonus Lunar card included.

- A stand-out metal card with personalised laser engraving.

- Extended travel insurance with Tryg.

- +1% interest on your whole balance. Interest is variable, calculated annually and paid out monthly.**

- Wolt+ included.

No negative interest.

No matter whether you have an interest savings account or regular account with us, we won’t apply negative interest rates.

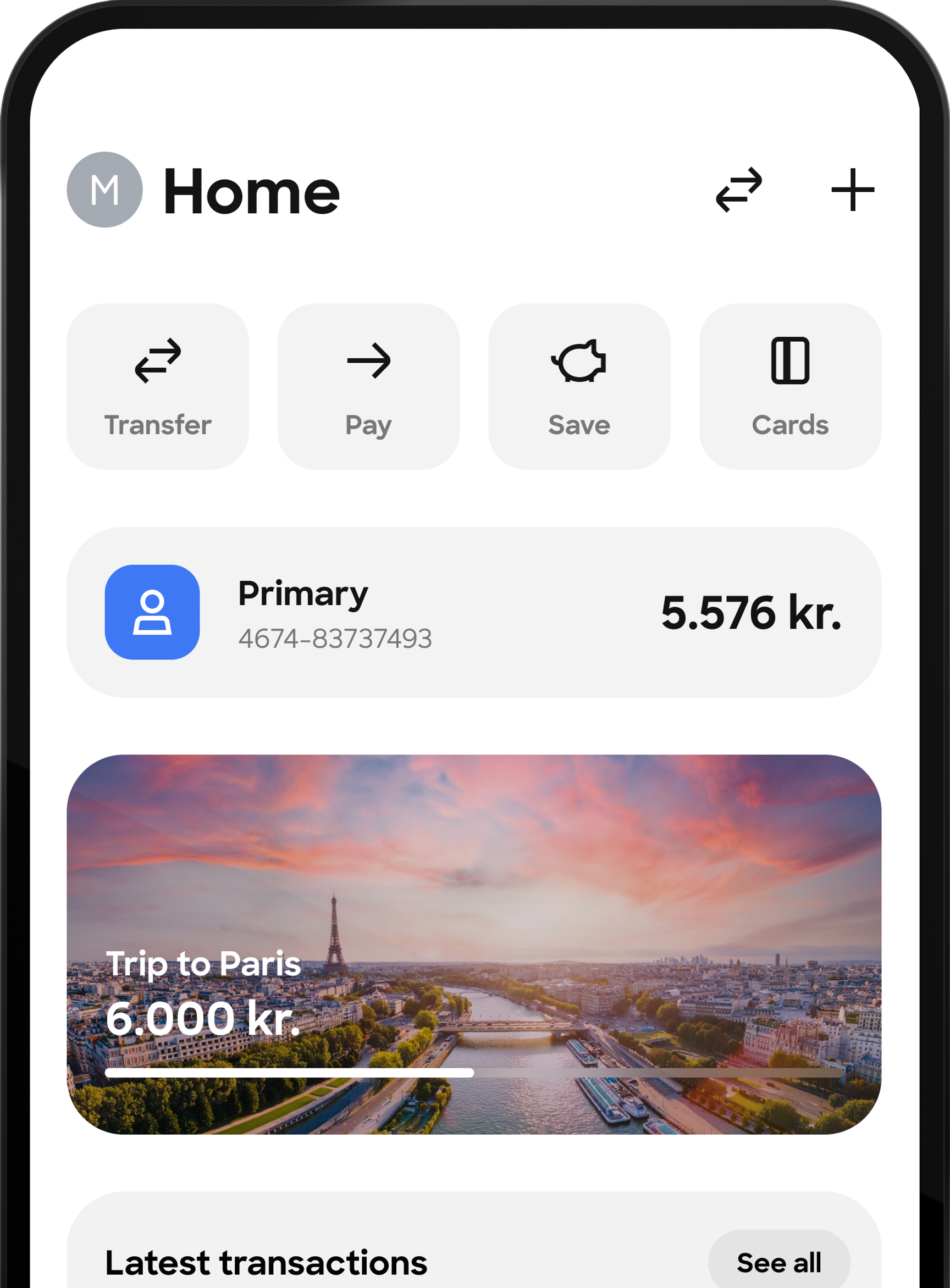

How to get your interest savings account

- 1

Download Lunar from App Store or Google Play.

- 2

Sign up in the app in minutes. Remember to have your picture ID ready.

- 3

When you’ve been approved, you can create your interest savings account immediately. You’ll find it under ‘Products’.

Your questions answered

What is an interest savings account?

With a savings account, earn up to +2,25% interest when you deposit and bind your money.

You can deposit between 25,000 DKK and 1,000.000 DKK; the interest rate depends on whether you bind your money for 3 months 6 months, 1 year or 3 years, and whether you have Light, Standard, Plus or Unlimited.

Light:

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 months: +1.50%

- Interest rate 25,000 DKK to 1,000,000 DKK for 6 months: +1.25%

- Interest rate 25,000 DKK to 1,000,000 DKK for 1 year: +0.75%

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 years: +0.75%

Standard:

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 months: +1.50%

- Interest rate 25,000 DKK to 1,000,000 DKK for 6 months: +1.25%

- Interest rate 25,000 DKK to 1,000,000 DKK for 1 year: +0.75%

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 years: +0.75%

Plus:

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 months: +1.75%

- Interest rate 25,000 DKK to 1,000,000 DKK for 6 months: +1.50%

- Interest rate 25,000 DKK to 1,000,000 DKK for 1 year: +1.00%

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 years: +1.00%

Unlimited:

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 months: +1.75%

- Interest rate 25,000 DKK to 1,000,000 DKK for 6 months: +1.50%

- Interest rate 25,000 DKK to 1,000,000 DKK for 1 year: +1.00%

- Interest rate 25,000 DKK to 1,000,000 DKK for 3 years: +1.00%

You must bind your money for either 3 months, 6 months, 1 year, or 3 years. However, you can unlock the capital early for a fee of 4% of your total account balance. There is no requirement to use your Lunar card to receive the interest rate.

The Danish Guarantee Fund covers deposits up to 100,000 EUR (approx. 750,000 DKK). The cancellation period is 31 days.

When will I get my positive interest?

Can I earn a different interest rate if I change my plan after I get my savings account?

Can I deposit more money into my interest savings account after it’s been locked?

How will my interest be calculated?

Which terms are applied to the interest savings account?

What is Lunar?

Is my money protected at Lunar?