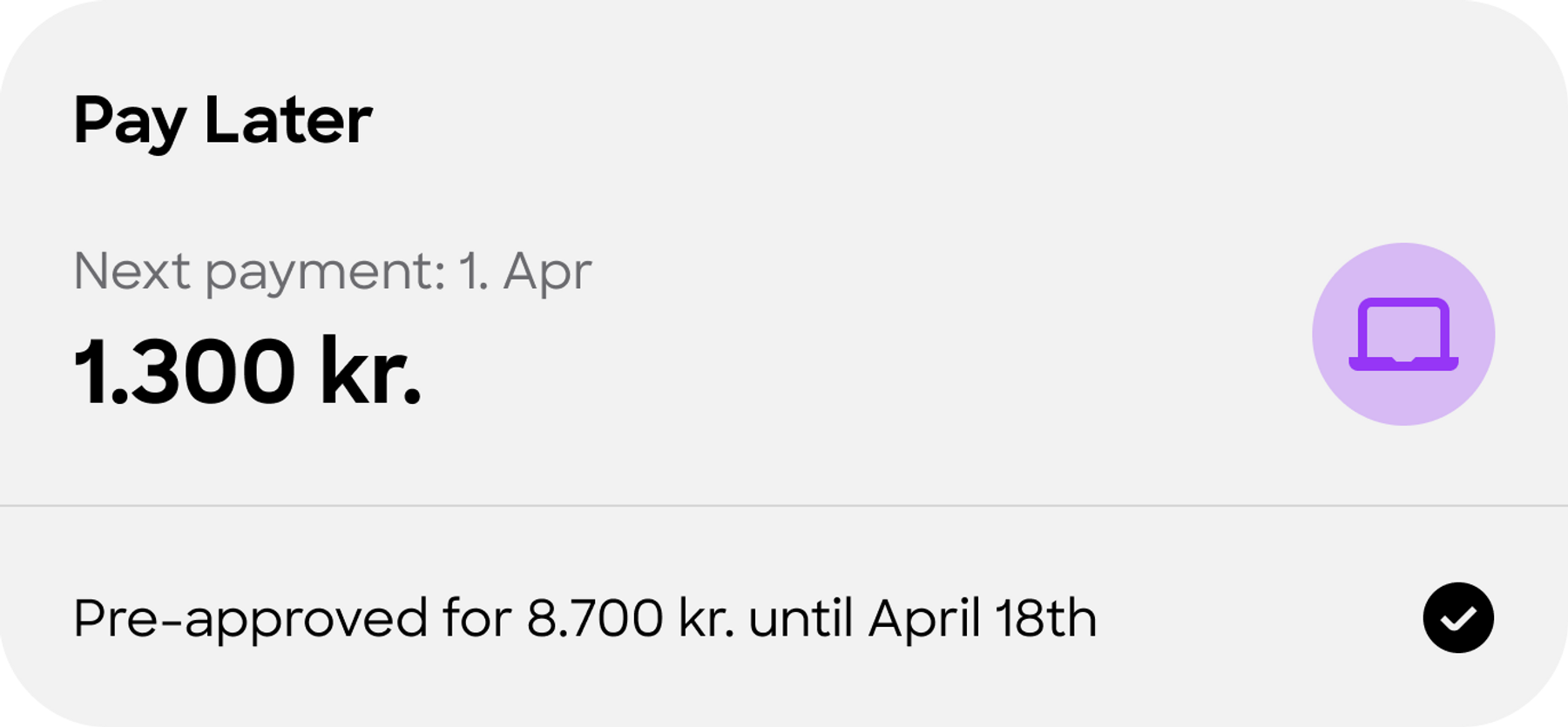

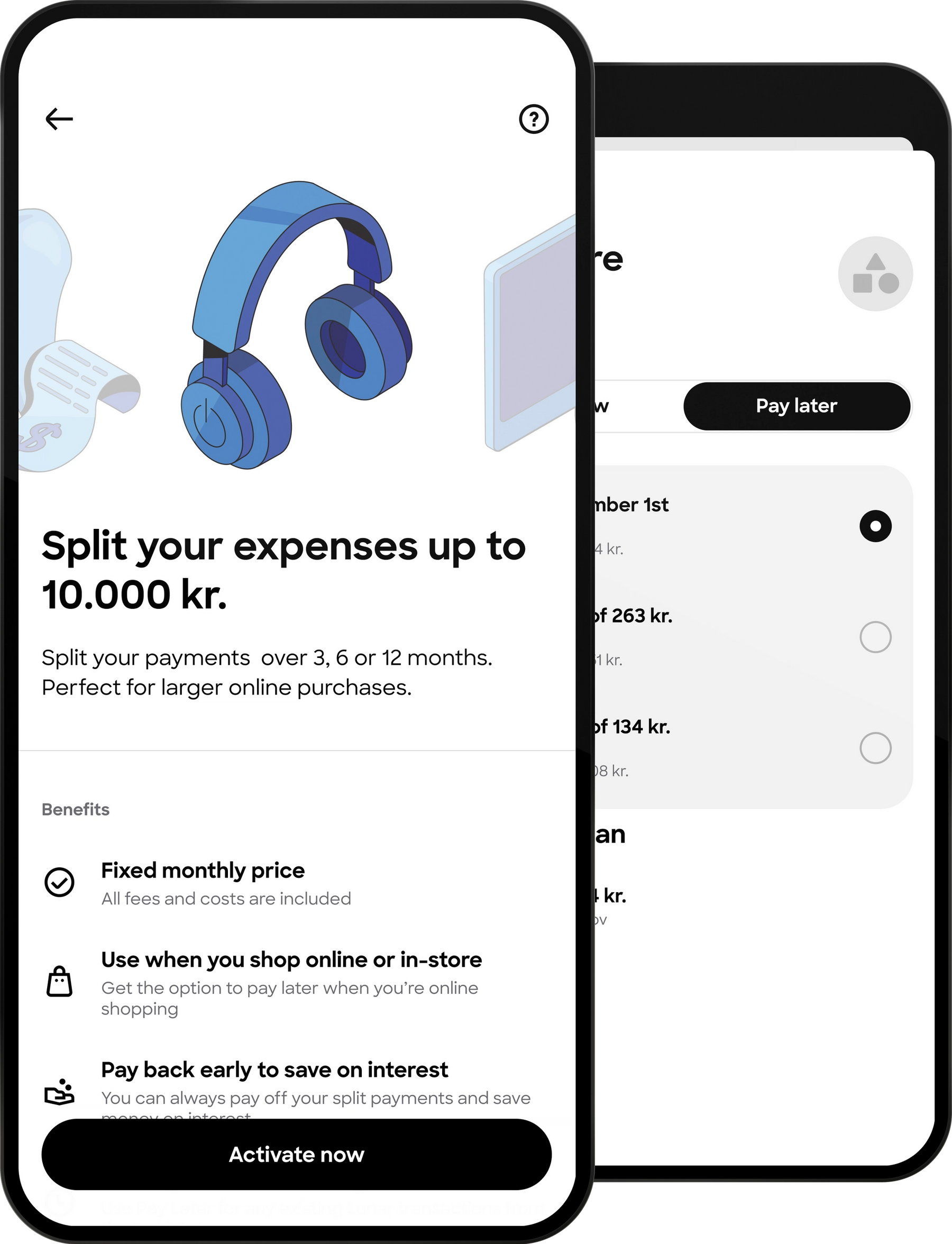

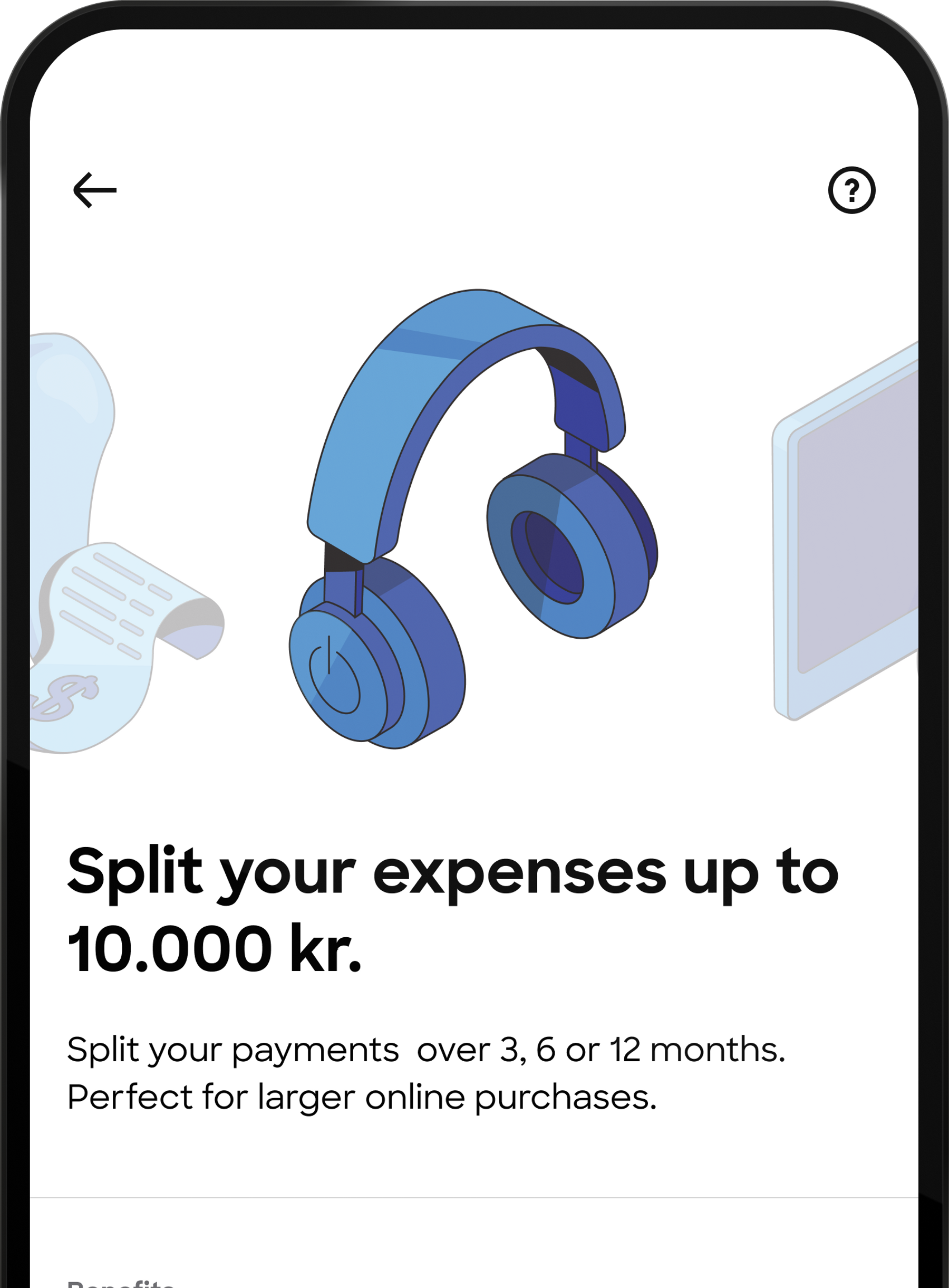

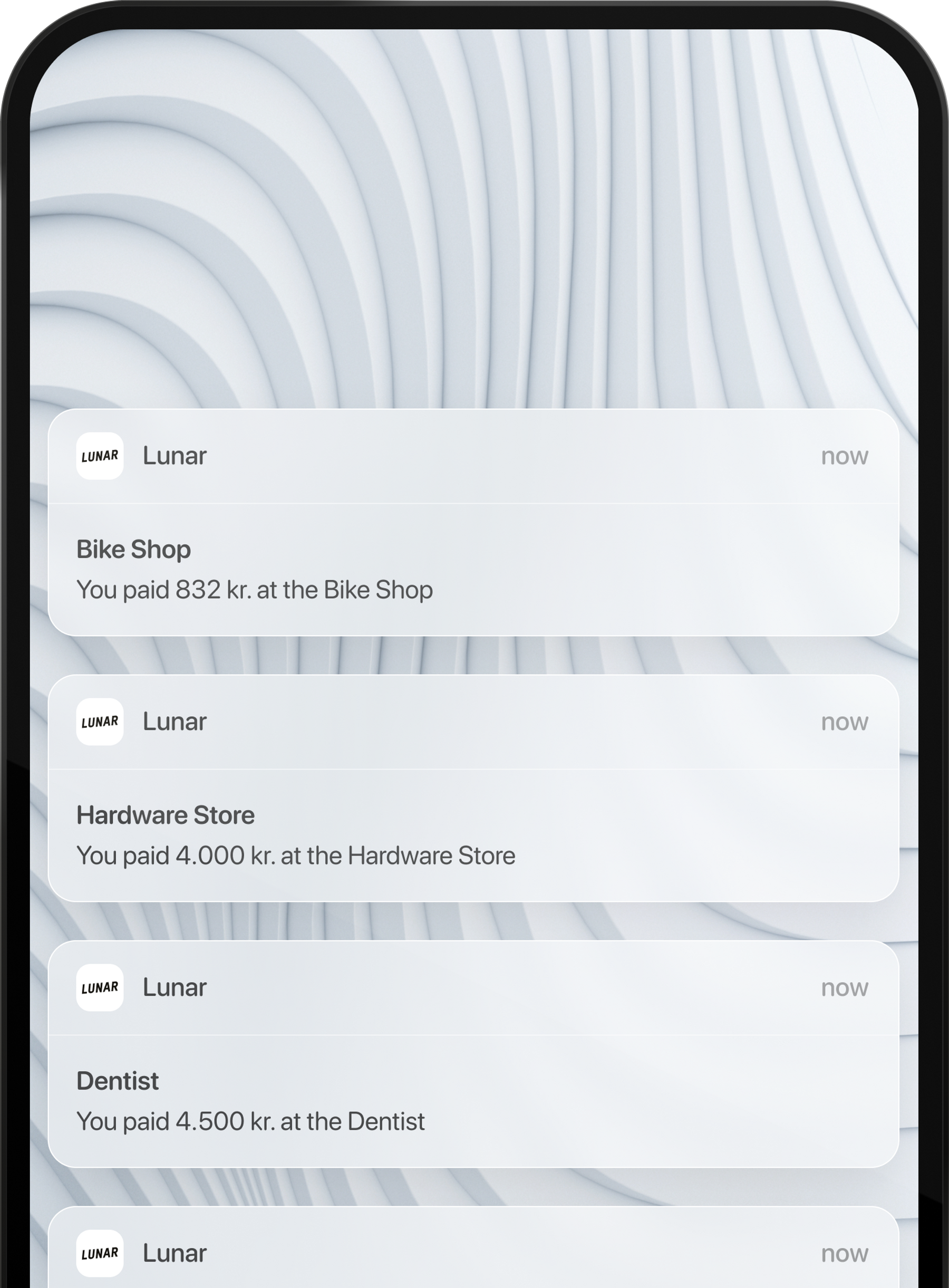

You no longer have to fear checking your account at the end of the month. Pay Later gives you more financial wiggle-room when you shop, or if you get an unexpected bill.

- Postpone and split up to 10,000 DKK.

- Flexible and transparent.

- Fixed price. No hidden fees.