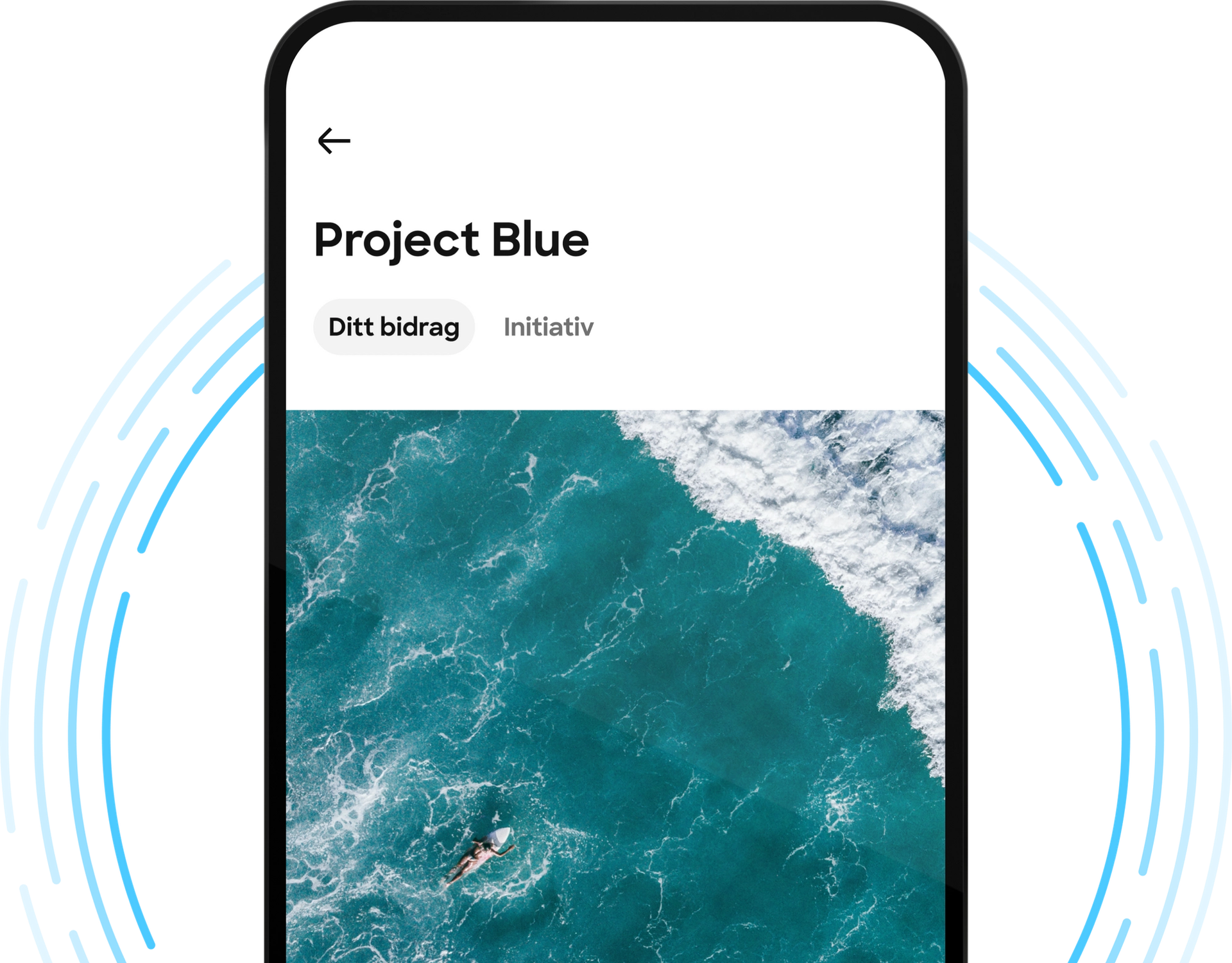

Project Blue and fighting ocean plastics 🌊

One of our Project Blue partners, Seven Clean Seas, recently had an insightful conversation with our very own Anne Marie Kindberg, Chief Revenue Officer, about Project Blue, its partners, and Lunar's commitment to this significant cause. Read more about purpose-driven banking, the value of transparency towards customers and take part of the interview right here.

At Lunar we believe in supporting purpose-driven banking to help create positive impacts on society and the planet while also generating sustainable financial returns. Through our initiative Project Blue we strive to support change, by making waves in the fight against ocean pollution. Because much like the mission of becoming the best everyday bank, cleaning up the oceans doesn’t happen overnight. It takes innovation, dedication and collaboration.

Plastic in our oceans is a global crisis with 8 000 000 tons ending up in our oceans every year. By supporting Project Blue, together with our users, we actively fight against this development with the end goal of making a difference in our everyday lives.

For any amount that customers contribute, Lunar adds 2% to the total contribution to our partners — one of them being Seven Clean Seas, an organization dedicated to tackling the problem of plastic pollution in our oceans. They had an insightful conversation with our very own Anne Marie Kindberg, Chief Revenue Officer, about Project Blue, its partners, and Lunar's commitment to this significant cause. 💙

Lunar took its commitment to the ocean to a whole new level, could you elaborate on why this is important?

We strive to drive purpose-driven banking. We try to build what we call the best everyday bank in the Nordics, but we also have a purpose that goes beyond the core customer promise — making positive impacts on society and engaging with the challenge of climate change.

Plastic in the oceans is part of the global climate crisis. We can’t fix everything, but we can do something. Together with our customers and partners, we contribute to help make the Nordic seas cleaner, as well as other oceans around the world.

Is there any reason why the company chose to contribute to the oceans instead of other initiatives?

The decision was made after we assessed different kinds of partnerships, as well as listening to our customers to find out what they would like to contribute to and how we could have joined efforts. It also really came from the passion within the team, because plastics in the oceans are a visible part of the climate crisis, right?

How does Lunar demonstrate transparency, accountability, and encourage participation in Project Blue?

First of all, we always report everything back to customers. We strive to be transparent about what has happened and how much plastic they have helped remove from the oceans.

We also continue to communicate with our existing, non-participating customers that this is an opportunity for them. You can find Project Blue in our app and it’s very easy to understand how you can take part in it. It’s also very flexible as you’re not forever tied to the program and can tune out the next month if you want.

In terms of partnerships, of all the samples we had assessed together with a consultancy house, Seven Clean Seas was our favorite with a very solid background and here we are!

The impact of pollution is often far away from the eyes of European citizens, especially those living in a "bubble" like Copenhagen, Berlin, Stockholm, etc. How can we make everyone understand the impact we all have on the planet?

I would say that the Nordics live relatively more sustainably in many ways. It’s mostly clean, you don’t directly see the effects of climate change, and no big temperature swings yet. So one way to approach this is by avoiding the guilt-tripping type of communication.

We approach our consumers with what we call better choices and positive opportunities. At the same time, we also communicate a very globally visible issue which is plastics in the oceans. We show that you can contribute to a tangible issue and do something about it in a positive way.

Our ambition is to empower our users, to give them a positive impact. This is why Lunar also contributes together with our customers and top up their total contribution. We ask them to spend part of their money on this, so it needs to be something that gives them meaning.

How does the partnership with Seven Clean Seas fit into Lunar's ESG strategy?

It’s great! We take responsibility for climate change so this partnership fits naturally. A big part of our ESG strategy also focuses on what we can do in terms of carbon emissions.Today, our target age groups have become more diverse, in contrast to our earlier focus on younger consumers. Because while it’s true that awareness is still highest among younger people, more and more people of all age groups are also getting more interested and taking more real actions toward environmental issues. We also had our climate election for the Parliament four years ago here in Denmark, where the more mature part of the population showed their interest in environmental issues as well, so that’s saying something.

Let’s talk about your experience, Anne Marie. How did you perceive or relate to sustainability and social impact throughout your career at different tech companies?

Interesting question. I think overall, tech companies have been quite vocal and early on these agendas. I don’t know if it’s because it’s a modern industry or because tech companies have many younger employees.

Personally, I think it’s very natural that any kind of company takes social and climate responsibility. It’s part of running a business — at least within the tech companies I’ve worked for.

Do you think tech companies are better suited to push a genuine sustainability agenda compared to more traditional businesses?

No, I believe traditional businesses should just be as well equipped for running the same kind of agendas. I think other industries are also taking great climate responsibility. Kudos to tech companies, though, for being early.

What do you think about the banking and fintech industry in terms of going toward these issues — due to their funding and reach of the customer base?

Interesting. Coming from a traditional take, as I worked in Microsoft before, it was integrated as part of the company's DNA.

Many of the fintech companies - especially thinking about neobanks - were established around … mid-2010s, right? My best guess would be that if they had been founded a few years later, ESG would have been an even more natural part of the DNA, with a zero-emission kind of approach from day one. But, fintechs are also very nimble, and change is part of their DNA, so I wouldn’t be surprised if we see more innovative initiatives from these companies going forward.

When it comes to investors they are also asking for ESG. Likely they will help push social agendas if the companies don’t do it themselves. On the other hand, traditional banks are moving quite fast regarding this. Basically, all companies need to get into ESG and social responsibility agendas. Turning backs is not an option.

Thank you for the interesting insights! I have one last, surprise question — what’s your personal relationship with the oceans like?

My family and I really love the oceans! We have a sailboat and we love spending time by the sea with the kids on weekends. The ocean is our family place and something that we’re deeply connected to. It’s a big part of our lives.

You might also like...

From office lights to living rooms, we now match all our employees’ electricity use with renewable energy

This change is about doing what we can here and now. We’re extending renewable electricity matching from our offices in Sweden and Denmark...

AI Support now resolves 85% of cases on its own, with top ratings to match. Here’s how.

AI chatbots are everywhere, but too often they miss the point. You type a question into a chat bubble, get something almost useful back,...

Travel Costs Are Predictable. Your Card Fees Should Be Too.

Roaming charges in the EU are no longer an issue, making phone use abroad simple and predictable. Paying with your bank card, however,...

Imagine seamless, quick payments across borders. Now a reality.

International payments are now faster, more transparent, and more cost-effective. Through our partnership with Wise Platform, you can send...