Is polkadot safe?

Crypto and polkadot are still relatively new concepts, and therefore many countries don’t allow cryptocurrencies, polkadot included, as a payment method yet.

If you’re thinking about investing in polkadot, you need to be aware that all cryptocurrency trading is connected to risks and uncertainty .

Lastly, you need to understand the underlying technology behind polkadot – the blockchain – and how that technology can be considered to be safe or unsafe.

To know whether polkadot is safe you need to keep three things in mind:

- Which countries allow cryptocurrency as a payment method?

- Why is polkadot connected to risks and uncertainty?

- How safe is polkadot technologically speaking?

What countries allow polkadot as a payment method?

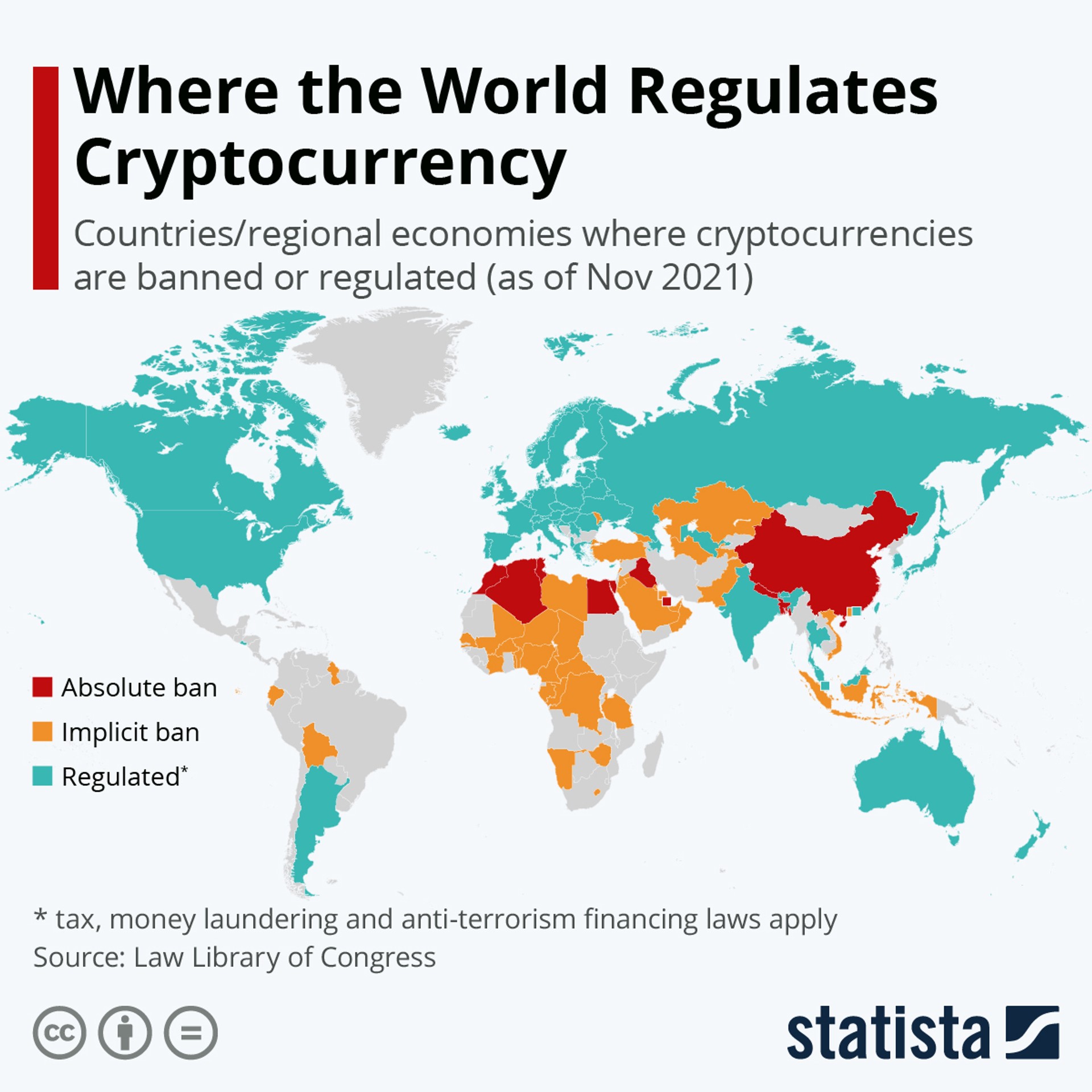

Polkadot can be an uncertain currency to carry if you’re planning to use it as a means of payment . There are still a lot of countries that don’t accept polkadot and cryptocurrencies in general as a legal payment method.

On the map from Statista you can see which countries who:

- regulates crypto (blue)

- implicitly bans crypto (yellow)

- directly bans crypto (red)

Why is polkadot connected to risks and uncertainty?

When you trade polkadot there’s a risk that you could lose some or the entirety of your holding. Polkadot and cryptocurrencies in general are unregulated which means that there are no central authorities to protect consumers.

If you have money in a bank, and the bank goes bankrupt, your money is protected by a central authority: In Denmark, that authority is Garantiformuen. Garantiformuen covers deposits on amounts corresponding to 100,000 EUR per depositor and securities on up to 20,000 EUR per investor.

But if you lose your polkadot following a cryptoplatform going bankrupt, you’re not protected by any authorities.

That is one of the reasons why polkadot is an uncertain investment.

Besides that, polkadot is a very volatile asset. This means that prices can rise and fall very quickly. The more volatile an investment is, the more uncertain it is. The same goes for all types of assets. For example, if you were considering buying a house, you would be more careful with your purchase if you knew that the price of the house potentially could lose up to 100% of its value from one day to the next. At the same time, there’s also a risk that the house could be worth 10 times the price the next day.

That’s kind of how polkadot works. You should consider whether polkadot fits your readiness to take risks.

And lastly, polkadot is one of the newer cryptocurrencies. That means that there’s not a lot of historical data, which you can lean on, when analysing the cryptocurrency.

That makes polkadot more risky than older cryptocurrencies with more historical data – such as bitcoin or ethereum .

Historical data and past price developments are however not an indication of future developments. Cryptocurrencies can rise and fall quickly in a short period of time.

What is a layer 0 blockchain?

A layer 0 blockchain covers the most basic elements of a blockchain. It is the skeleton of a blockchain itself.

A layer 0 blockchain consists of the most fundamental components: internet, hardware, protocols and connections.

Protocols refer to the mathematical frameworks, which are coded into the blockchain, and makes it possible to transfer value from one computer to another.

Like that, a layer 0 blockchain is the underlying infrastructure for a sustainable blockchain and thus cryptocurrency.

Polkadot is a layer 0 blockchain, because polkadot’s primary function is to facilitate transfers of value across existing blockchains – or more specifically across existing layer 1 blockchains

Read more about the possibilities that the polkadot technology offers.

Other layer 1 blockchains can thus use polkadot’s layer 0 solution, no matter which type of infrastructure and technology that’s in the layer 1 blockchain.

What’s a layer 1 blockchain?

A layer 1 blockchain is what people typically refer to when talking about blockchains.

Examples of layer 1 blockchains are bitcoin , ethereum , and solana’s blockchains.

A characteristic of layer 1 blochains is that they have their own ledger , their own technological infrastructure, their own consensus-mechanism , their own network of participants, their own crypto coin or token, and their own encryption algorithm.

In other words, a layer 1 blockchain is an independent product that can work independently of other blockchains.

What’s a layer 2 blockchain?

Where layer 1 blockchains can work independently from other blockchains, layer 2 is the opposite. Layer 2 blockchains is a supplementary technology, which is laid on top of existing blockchain technologies to improve their layer 1.

An example of a layer 2 blockchain is polygon .

Polygon is specifically developed to support ethereum’s blockchain . Users of ethereum’s blockchain have run into a number of challenges with high costs because ethereum’s layer 1 blockchain isn’t fit to service that many people.

That’s why polygon was developed: to relieve the primary network – meaning the layer 1 blockchain. By getting people over to a layer 2 solution in the form of polygon, the people behind polygon have improved the user experience on ethereum’s blockchain.

So how safe is a layer 0 blockchain?

Because polkadot connects blockchains via its own platform – the so-called relay chain – and the fact that users from other blockchains can get access to polkadot’s economy (meaning DOT tokens) to facilitate transactions and activities, polkadot’s technology strengthens the overall security.

Example:

To run a layer 1 blockchain, a lot of computer power and finances are needed to facilitate it. In the long run, there’s potential for the computing power and finances to be centralised with one participant, who then has the opportunity to hack the blockchain.

This is not just a thought experiment, it did happen to ethereum’s blockchain in January 2019 .

To hack a blockchain, you’d need to “control” over 51% or more of the transaction blocks in the blockchain. By using polkadot as a layer 0 solution, the “control” over transaction blocks lies with polkadot, and not with the actual blockchain operator (in this instance, ethereum).

And because polkadot uses nominated proof-of-stake instead of proof-of-work to validate transaction blocks, the security will already be better at that point – theoretically speaking.

Besides that, a layer 0 blockchain such as polkadot also makes it possible for newer blockchains with fewer transaction blocks to benefit from polkadot’s underlying relay chain with its transaction blocks.

In other words: A new cryptocurrency can be easy to attack, because the blocks of data aren’t very “long” yet. The more transaction blocks in a blockchain, the more safe it theoretically is.

When a new cryptocurrency connects to polkadot’s blockchain, the new crypto benefits from polkadot’s longer transaction history, which in theory will strengthen the overall security against hacker attacks.

However, this only counts for cryptocurrencies who use proof-of-work – like ethereum and bitcoin, among others, use.

Cryptocurrencies can rise and fall

When you trade cryptocurrencies, you need to be aware that it carries a large risk. The value of your cryptocurrency can both rise and fall, and you can risk losing the entire amount you’ve invested in cryptocurrencies.

Cryptocurrency trading is done through Lunar Block. Lunar Block is not regulated by the Danish Financial Supervisory Authority (Finanstilsynet). That means you won’t have the same protection as when trading e.g. stocks or other regulated assets.

We do not counsel

We do not advise on currencies and do not make recommendations for either buying or selling. We can provide factual information about the different currencies, but past price developments are not an indication of future developments.

No information from Lunar Block should therefore be considered as recommendations and all decisions are up to you alone.

Last updated April 18, 2023. We’ve collected general information. Please note, that there may be specific circumstances that you and your business need to be aware of.

You might also like...

Where can I pay with solana?

Cryptocurrency is becoming so widespread and acknowledged abroad that you can use the currency just like regular payment methods on some...

How do you buy solana as regular stocks?

Because solana (SOL) is a currency, and not a business, you can’t actually invest directly in solana like it’s a stock.

Are cryptocurrencies a good investment?

Cryptocurrencies can be a great addition to your portfolio - if you’re willing to run the risk. Cryptocurrencies are “high risk - high...

What is bitcoin?

Bitcoin is a digital currency, or cryptocurrency, as it’s also called. Bitcoin is the first and largest cryptocurrency measured on market...